Contents

Key Tax rates in Latvia

2025 tax rates at glance

- Corporate income tax (CIT) rate: Standard rate 20 % is applied to the gross amount, or 20/80 (effective rate 25%) of the net cost.

- Personal income tax (PIT) rates:

- 25.5% for annual income up to EUR 105 300;

- 33% for annual income exceeding EUR 105 300;

- 25.5% for income from capital gains;

- 10% for income from property.

- An additional 3% rate applies to the portion of annual income exceeding EUR 200,000 (paid by the individual when submitting the Annual Income Declaration).

- Fixed non-taxable minimum for everyone regardless of gross income – EUR 510 per month.

- Social tax rates:

- Employee’s liability is 10.50%;

- Employer’s liability is 23.59%;

- Solidarity tax rate 25% for annual income above EUR 105 300.

- Minimum object of mandatory social tax contributions EUR 740 per month.

- Value added tax standard rate 21%, reduced rates 12% and 5%.

- Value added tax registration threshold EUR 50 000.

- The minimum wage EUR 740 per month.

- Micro-enterprise tax rate (consists of State social insurance mandatory contributions, personal income tax for micro-enterprise owner) – 25%.

Key Latvian tax changes as of 2025

Changes in the value added tax (VAT) law

As of 1st January 2025:

- The 12% VAT rate for supplies of fresh fruits, berries and vegetables specific to Latvia, which are specified in the Annex to the VAT Law, has been set as a permanent norm.

- VAT relief has been established for small and medium sized enterprises:

- such companies which carry out VAT taxable transactions in other EU member states have the right to apply the VAT exemption of the relevant EU member state as determined by the specific member state;

- it should be noted that the company's annual turnover must not exceed the exemption threshold of the relevant member state and the total turnover in the EU of 100 000 euros.

- mentioned also applies to VAT payers from other member states if they carry out VAT taxable transactions in Latvia.

- It is determined that the registration threshold in the VAT payer register must be calculated for a calendar year.

- In addition to transactions subject to VAT, the VAT registration threshold must also include the following non-taxable transactions: real estate transactions, financial and insurance services.

- Transitional period has been set for those who have exceeded the VAT registration threshold - they will be able to continue not to pay VAT until the end of the calendar year, if their turnover in the relevant year does not exceed the registration threshold by more than 10%. If the threshold is exceeded, then there is an obligation to become a VAT payer and pay VAT from the moment of exceeding.

- New medical services that are exempt from VAT have been defined – nutritional recommendations prescribed during the treatment process, pharmaceutical care provided in pharmacies and the service of a mobile palliative care team.

- Regulation regarding the application of the special VAT regime in transactions with used goods, works of art, collectors' items and antiques has been clarified.

- Place of supply of services for virtual cultural, sporting and similar events is determined as the place of business or residence of the recipient of the service.

- Simplified procedure has been established for transactions with diplomatic and consular missions.

Changes in the personal income tax (PIT) law

As of 1st January 2025:

- Two-stage progressive PIT rates have been implemented – 25.5% (for income up to 105 300 euros per year) and 33% (for income above 105 300 euros per year).

- Instead of a differentiated non-taxable minimum a fixed non-taxable minimum has been implemented, which will apply to all employees regardless of their gross income. The non-taxable minimum in 2025 is 510 euros.

- Additional PIT rate of 3% has been implemented for income above 200 000 euros per year. The taxable base at a rate of 3% will include income subject to PIT as well as other separate income such as dividends, income equivalent to dividends, conditional dividends, liquidation quota. The additional 3% personal income tax rate is paid by the individual when submitting the Annual Income Declaration.

- PIT rate for income from capital gains and income from capital other than capital gains has been increased to 25.5%.

- PIT relief for employer collective agreement payments has been increased and will also apply to employee relocation, accommodation and transportation expenses. The amount of the relief is set for all employees and its annual amount may not exceed the amount obtained by multiplying the average number of employees by 700 euros.

- Non-taxable minimum for all types of pension recipients has been increased to 12 000 euros per year or 1 000 euros per month.

- PIT relief for childbirth and funeral benefits paid by the employer to an employee has been increased to 500 euros per year.

- PIT relief for employer gifts has been increased to 100 euros per year.

- Unified PIT exemption has been established for material and cash prizes, bonuses received in contests and competitions up to 1 500 euros per year.

- Period during which royalty recipients have the option not to register as economic operators has been extended until 31 December 2027.

- The period during which amounts paid as support to agriculture are not included in income subject to PIT has been extended until the year 2029.

Changes in the micro-enterprise tax (MET) law

As of 1st January 2025:

- Person's rights to re-registration under the MET regime have been determined (re-registration is also possible during the period when economic activity and tax payment were suspended, and in the post-taxation period, if economic activity was not carried out under another tax regime).

- The period after which a MET payer loses its status if it had no turnover has been extended by one taxation year.

- It is determined that the MET payer status will be lost with the next taxation period if the taxpayer has no turnover for two consecutive taxation periods; if the company is registered as a MET payer starting from the second quarter of the taxation period and has no turnover for three consecutive taxation periods.

Changes in the lotteries and gambling fee and tax law

As of 1st January 2025:

- Increased tax rate for lotteries and instant lotteries to 15%.

- Gambling fee for re-registration of a gambling license has been increased to 45 000 euros.

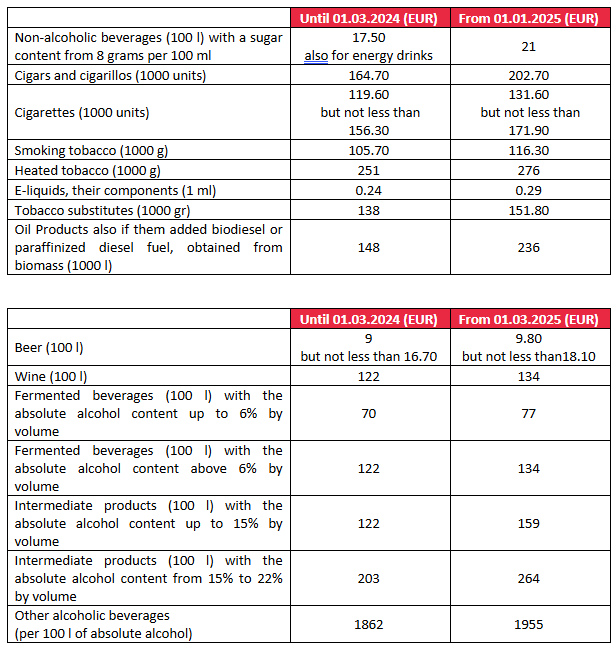

Changes in the excise duty law

The table shows some of the excise tax changes, however, it should be noted that there are also other rate changes (for alcoholic and non-alcoholic beverages, petroleum products, natural gas, etc.).

Changes in the natural resources tax (NRT) law

As of 1st January 2025:

- Increased NRT rate for coal, coke, and lignite. With thermal input (GJ/t) indicated in accompanying documents – 0.90 euros per GJ/t, if thermal input is not indicated in accompanying documents – 25.20 euros per tonne.

Solidarity contributions

As of 1st January 2025:

- It is determined that credit institutions registered in Latvia and branches of credit institutions of other countries in Latvia must make solidarity contributions, applying a rate of 60% to the solidarity contribution base.

Changes in the vehicle operation tax (VOT) law

As of 1st January 2025:

- Increased VOT rates for all vehicles as well as trailers and semi-trailers by an average of 10%.

- New VOT payment deadline has been set – 31 January of the year following the calendar year.

If you have any questions, please do not hesitate to contact us