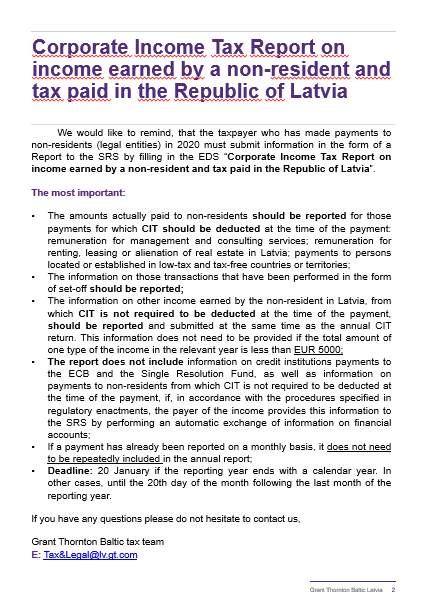

We would like to remind, that the taxpayer who has made payments to non-residents (legal entities) in 2020 must submit information in the form of a Report to the SRS by filling in the EDS “Corporate Income Tax Report on income earned by a non-resident and tax paid in the Republic of Latvia”.

The most important:

- The amounts actually paid to non-residents should be reported for those payments for which CIT should be deducted at the time of the payment: remuneration for management and consulting services; remuneration for renting, leasing or alienation of real estate in Latvia; payments to persons located or established in low-tax and tax-free countries or territories;

- The information on those transactions that have been performed in the form of set-off should be reported;

- The information on other income earned by the non-resident in Latvia, from which CIT is not required to be deducted at the time of the payment, should be reported and submitted at the same time as the annual CIT return. This information does not need to be provided if the total amount of one type of the income in the relevant year is less than EUR 5000;

- The report does not include information on credit institutions payments to the ECB and the Single Resolution Fund, as well as information on payments to non-residents from which CIT is not required to be deducted at the time of the payment, if, in accordance with the procedures specified in regulatory enactments, the payer of the income provides this information to the SRS by performing an automatic exchange of information on financial accounts;

- If a payment has already been reported on a monthly basis, it does not need to be repeatedly included in the annual report;

- Deadline: 20 January if the reporting year ends with a calendar year. In other cases, until the 20th day of the month following the last month of the reporting year.

If you have any questions please do not hesitate to contact us,

Grant Thornton Baltic tax team

Also appears under...