On 16 July 2020, the European Union Court of Justice (CJEU) passed judgment C-311/18 (Schrems II), invalidating the US-EU certificate programme Privacy Shield, which ensures data transmission security.

Assurance

Corporate accounting and outsourcing

Tax services

-

Value added tax

We have extensive knowledge in the field of value-added-tax, excise duties and customs, both on the national and international level.

-

Corporate income tax

We advise on all matters related to corporate taxation

-

Transfer pricing

At Grant Thornton Baltic, our tax, legal and financial advisers assist you in all matters related to transfer pricing.

-

Tax risk management

Tax risk management

-

Due diligence

We identify the risks in different taxation areas (incl., corporate income tax, value added tax, payroll taxes, transfer pricing, transactions with non-residents). We prepare a report summarising any deficiencies and problems discovered and make proposals for their elimination.

-

International taxation

Companies need clear strategies for tax efficient cross border business

-

Taxation of private individuals

We provide our clients with integrated solutions. We advise clients in the preparation of income tax declarations as well as interpretation of different provisions regulating tax exemptions and tax incentives. For sole proprietors, we arrange accounting, prepare income tax declarations, and communicate with the tax authorities.

Related insights:

Data protection and information security

-

GDPR audit

GDPR audit

-

DPO as a service

DPO as a service

-

Data protection advisory services

Data protection advisory services

-

Data protection impact assessment

Data protection impact assessment

-

Information security audit

Information security audit

Related insights:

Data protection

Transmission of personal data to the US – mission impossible?

Business advisory and valuation services

-

Business advisory

Experienced financial advisers assist clients in all stages of their companies’ life cycle.

Career

Work for profesionals

Students

Vacancies

Vacancies for students

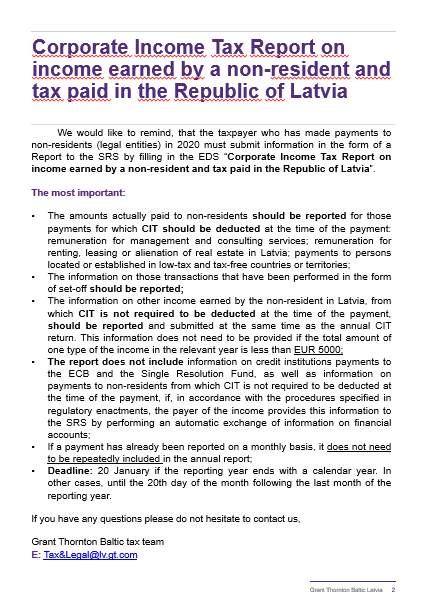

We would like to remind, that the taxpayer who has made payments to non-residents (legal entities) in 2020 must submit information in the form of a Report to the SRS by filling in the EDS “Corporate Income Tax Report on income earned by a non-resident and tax paid in the Republic of Latvia”.

The most important:

- The amounts actually paid to non-residents should be reported for those payments for which CIT should be deducted at the time of the payment: remuneration for management and consulting services; remuneration for renting, leasing or alienation of real estate in Latvia; payments to persons located or established in low-tax and tax-free countries or territories;

- The information on those transactions that have been performed in the form of set-off should be reported;

- The information on other income earned by the non-resident in Latvia, from which CIT is not required to be deducted at the time of the payment, should be reported and submitted at the same time as the annual CIT return. This information does not need to be provided if the total amount of one type of the income in the relevant year is less than EUR 5000;

- The report does not include information on credit institutions payments to the ECB and the Single Resolution Fund, as well as information on payments to non-residents from which CIT is not required to be deducted at the time of the payment, if, in accordance with the procedures specified in regulatory enactments, the payer of the income provides this information to the SRS by performing an automatic exchange of information on financial accounts;

- If a payment has already been reported on a monthly basis, it does not need to be repeatedly included in the annual report;

- Deadline: 20 January if the reporting year ends with a calendar year. In other cases, until the 20th day of the month following the last month of the reporting year.

If you have any questions please do not hesitate to contact us,

Grant Thornton Baltic tax team

Also appears under...